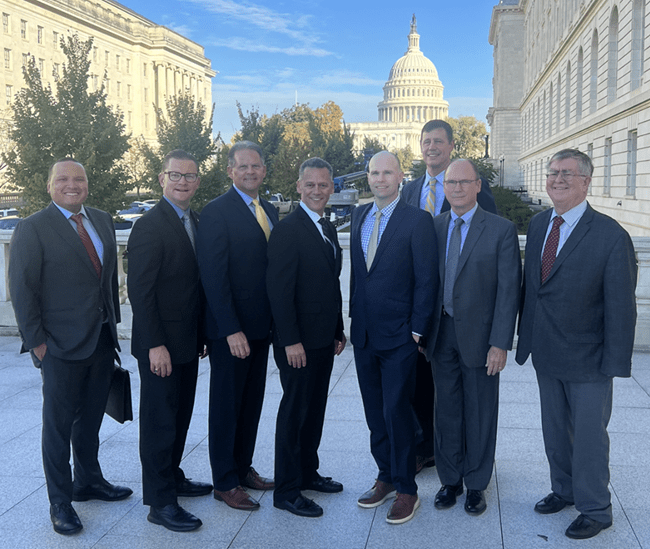

WASHINGTON, DC FLY-IN

WEDNESDAY, OCTOBER 25, 2023

Members of the SBLC, including NEMRA President Jim Johnson, participated in meetings on Capitol Hill to discuss pressing issues impacting the organization and its underlying members, including the Qualified Business Income Deduction (199A), the Main Street Tax Certainty Act, the Corporate Transparency Act, and general discussions of estate tax and the preservation of stepped-up basis allowance.

The SBLC members participated in seven meetings, and here are the recaps:

- House Committee on Ways and Means (R) – Majority Staff

Members met with the committee’s Tax Policy Advisor to House Ways and Means Chairman Jason Smith (R, MO-8) and discussed implications of the TCJA sun setting provisions and the path forward on a possible tax reform package in 2025.

2. Senate Committee on Finance Majority Staff (D)

Members met with the Chief Tax Advisor to Chairman Ron Wyden (D, OR) and learned about the Chairman’s priorities for the Section 199A qualified business income deduction.

3. Senate Committee on Finance Minority Staff (R)

Members met with Senior Tax Policy Advisors to Senate Finance Committee Ranking Member Mike Crepo (R, ID) and discussed the tax implications for small business succession planning and the merits of retaining a deduction for qualified business income

4. House Committee on Small Business Majority Staff (R)

Members met with the Coalitions Director for House Small Business Committee Chairman Roger Williams (R, TX-25) and discussed the adverse impact of beneficial interest disclosures mandated the Corporate Transparency Act and the need for regulatory certainty.

5. House Committee on Small Business Minority Staff (D)

Members met with a Senior Professional Staff Member responsible for taxation matters for House Small Business Committee Ranking Member Nydia M. Velázquez (D-NY, 7) and discussed the 2025 expiration of the 2017 Tax Cuts and Jobs Act (TCJA) deductions, including the need to avoid a tax increase on pass through business entities.

6. Office of Senator Todd Young (R, IN)

Members met with the Legislative Director to Senator Todd Young (R, IN), a member of the Senate Finance Committee, and discussed possible bipartisan areas of agreement for reducing the regulatory and tax burdens on small business.

7. Office of Rep. Beth Van Duyne (R-TX, 24)

Members met with the Legislative Assistant for Representative Van Duyne, who is a member of BOTH the Small Business and Ways and Means Committees, and discussed legislation that the Congresswoman has sponsored to reduce the regulatory burden on small businesses.

Special thanks to Senator Braun’s office and Representative Houchin’s office for providing escorts so that the SBLC Members could ride the Capitol Subway System as they navigated between the Senate and House meetings.

UPDATE: Speaker of the House Race

On October 25th, while the SBLC was holding meetings with committee and member staff, the House of Representatives elected Rep. Mike Johnson (R, LA-4) by a 220-209 vote. The chamber has been unable to hold votes on legislation since Oct. 3rd. Speaker Johnson is a fourth-term lawmaker who served as Vice Chair of the House Republican Conference. The House now faces Nov. 17 deadline to avert government shutdown and Speaker Johnson has floated a proposal for a continuing resolution through January or April 2024 if necessary, along with plan to act on remaining eight spending bills.